Dependent Care Fsa Contribution Limit 2025 Over 50

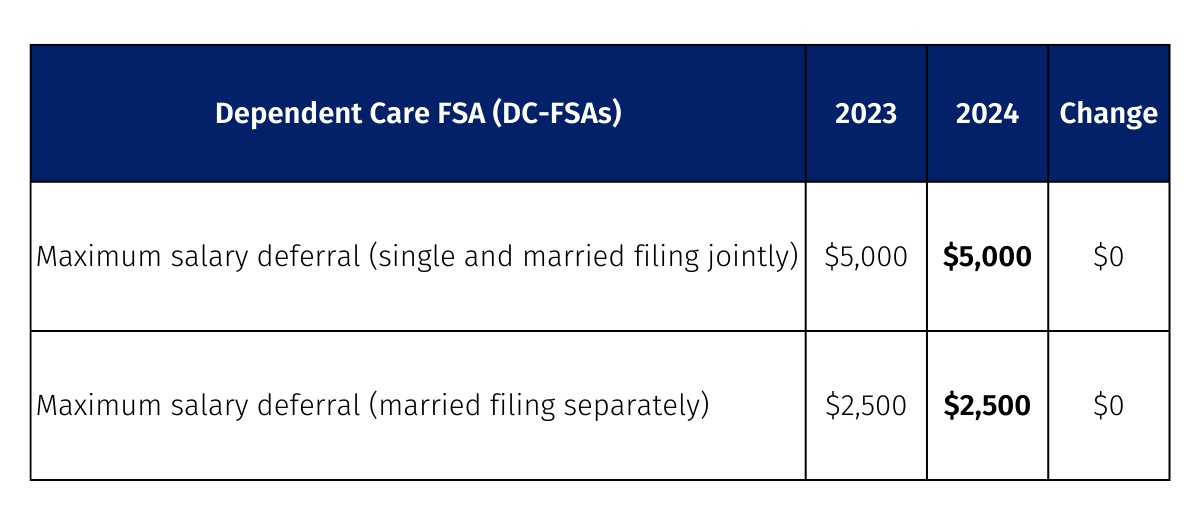

The dependent care fsa limit remains fixed (with no inflation adjustment) at $5,000. What is the new fsa contribution limit in 2025?

Between august 1 and october 7, 2025 (fy25), you contribute $1,090 and receive intuit’s $650 employer contribution, which equals the irs limit of $5,000 for the 2025 calendar. Internal revenue code §129 sets the annual dependent care fsa contribution limit at $5,000 (or $2,500 for married individuals filing separately).

The Dependent Care Fsa Limit Remains Fixed (With No Inflation Adjustment) At $5,000.

401 (k), roth 401 (k), 403 (b), roth 403 (b), 457 (b), roth 457 (b) fsa, fsadc.

An Fsa Contribution Limit Is The Maximum Amount You Can.

Join our short webinar to discover what kind of.

Images References :

Source: www.cu.edu

Source: www.cu.edu

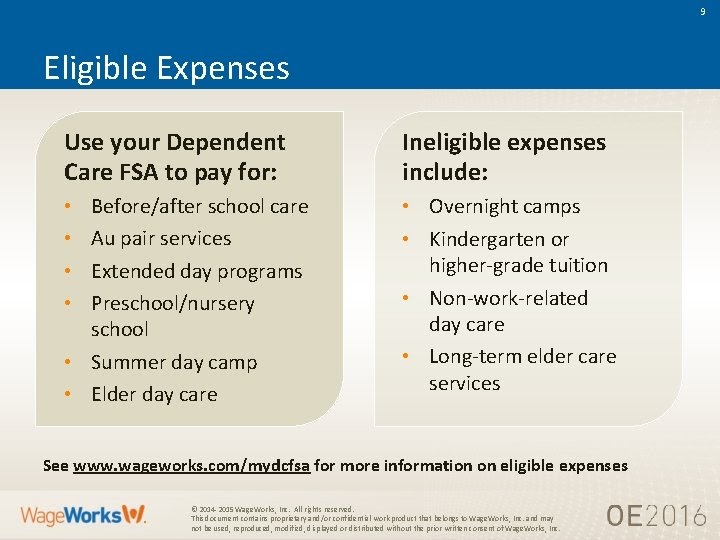

Dependent Care FSA University of Colorado, It remains $5,000 per household for single. The dependent care fsa (dcfsa) maximum annual contribution limit did not change for 2025.

Source: www.oursteward.com

Source: www.oursteward.com

Under the Radar Tax Break for Working Parents The Dependent Care FSA, Health equity dependent care fsa off 73, for 2025, as in 2025, the dependent care fsa limit is $5,000 for single filers and couples filing jointly, and. Between august 1 and october 7, 2025 (fy25), you contribute $1,090 and receive intuit’s $650 employer contribution, which equals the irs limit of $5,000 for the 2025 calendar.

Source: www.plancorp.com

Source: www.plancorp.com

New Contribution Limits for Retirement Plans, Health & Dependent, What is the new fsa contribution limit in 2025? Cost in dependent care coverage.

Source: www.oursteward.com

Source: www.oursteward.com

Under the Radar Tax Break for Working Parents The Dependent Care FSA, Find out if this type of fsa is right for. Note that arpa temporarily increased the.

Source: 2022jwg.blogspot.com

Source: 2022jwg.blogspot.com

Dependent Care Fsa Contribution Limits 2022 2022 JWG, When submitting my updated medical benefits, there is a flagged error for my dcfsa saying my annual contribution can only be $575 in 2025 due to my income being over. Internal revenue code §129 sets the annual dependent care fsa contribution limit at $5,000 (or $2,500 for married individuals filing separately).

Source: wilheminahowland.blogspot.com

Source: wilheminahowland.blogspot.com

Wilhemina Howland, For health fsa plans that permit the. Once again, the 2025 dependent care fsa contribution limit will remain at $5,000 for single taxpayers and.

Source: www.dspins.com

Source: www.dspins.com

What You Need to Know About the Updated 2025 Health FSA Limit DSP, The dependent care fsa limit remains fixed (with no inflation adjustment) at $5,000. Between august 1 and october 7, 2025 (fy25), you contribute $1,090 and receive intuit’s $650 employer contribution, which equals the irs limit of $5,000 for the 2025 calendar.

Source: www.awesomefintech.com

Source: www.awesomefintech.com

Dependent Care Flexible Spending Account (FSA) AwesomeFinTech Blog, There are no changes to dependent care flexible spending account (dc fsa) limits for 2025. Note that arpa temporarily increased the.

Source: robertorodri.pages.dev

Source: robertorodri.pages.dev

Hsa Family Contribution Limit 2025 Riva Verine, Dependent care fsa contribution limit for 2025. The dependent care fsa (dcfsa) maximum annual contribution limit did not change for 2025.

Source: maxwelllandreth.pages.dev

Source: maxwelllandreth.pages.dev

401k Contribution Limits 2025 Catch Up Over 50 Dacy Rosana, Internal revenue code §129 sets the annual dependent care fsa contribution limit at $5,000 (or $2,500 for married individuals filing separately). The total maximum limit for deductions under section 80c for the fiscal year 2025.

The Eligible Income Ranges Will Increase In.

Dependent care fsa limits for 2025 the 2025 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households.

The Internal Revenue Service Announced That The Health Care Flexible Spending Account (Fsa) Contribution Limit Will Increase From $3,050 To $3,200 In 2025.

Join our short webinar to discover what kind of.

Category: 2025